Det er ikke en utfordring å finne informasjon om investorpsykologi og hvilke tendenser som påvirker oss daglig, dette er det skrevet veldig mye om. Det var mer utfordrende å finne bevisene og i hvor stor grad våre handlinger ødelegger for oss, men jeg fant noe.

Bevisene

Etter litt kom jeg over en rapport fra analyseselskapet DALBAR, Inc., de har noen interessante opplysninger om saken. Siden 1994 har de analysert fondsinvestorer sine kjøp og salg, og bruker data tilbake til 1986. Konklusjonen er tydelig

Investment results are more dependent on investor behavior than on fund performance. Mutual fund investors who hold on to their investments have been more successful than those who try to time the market.

En av utfordringene er, vi klarer ikke å holde på investeringen i lang nok tid. Det lengste er smålige 4 år, og det i oppgangsmarkedene, til tross for at anbefalt holde tid er 10 – 15 år.

De viser hvor mye vi taper på dette ved å sammenligne annualisert avkastning til en gjennomsnittlig fondsinvestor mot S&P 500. Annualisert avkastning til S&P 500 fra 1986 til å med 2015 er 10,16 %, og den gjennomsnittlige fondsinvestor har en annualisert avkastning på 3,98 %.

Hvor forsvinner 6,18 % av avkastningen? De peker på kortsiktig tenkning og markedstiming. Investorer er ikke tålmodige nok, eller flinke til å kjøpe og selge på riktig tidspunkt, dette er psykologi. Transaksjonskostnader og andre ting påvirker også avkastningen negativt i forhold til en indeks, men at psykologi er en av de avgjørende effekten er det ingen tvil om.

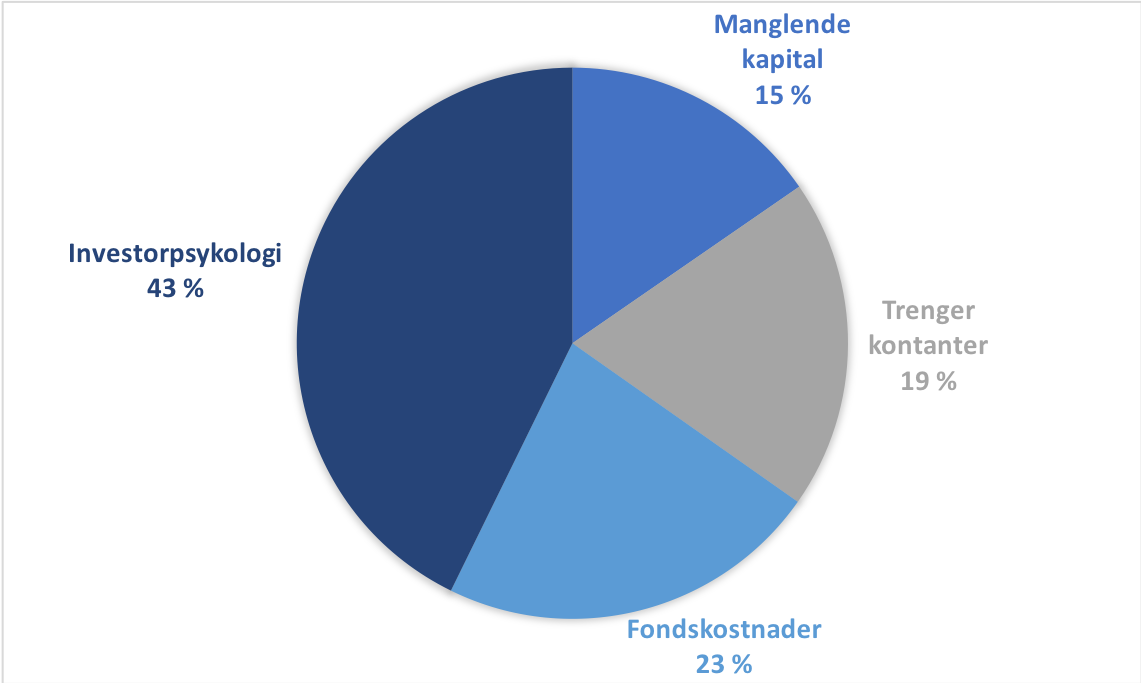

Når vi ser 20 år tilbake, har den gjennomsnittlige fondsinvestor underprestert S&P 500 med 3,52 %. Investorpsykologi står for 1,50 % av underpresentasjonen, i følge DALBAR, Inc. I kakediagrammet nedenfor har jeg lagt inn tallene fra rapporten, hvor de har delt opp 3,52 % i fire grunner til underprestasjonen.

Nesten halvparten av de tapte pengene til den gjennomsnittlige fondsinvestor er på grunn av psykologi. Vi har ikke tålmodighet/psyken til å holde fondene, selger i panikk, handler for ofte, og vi klarer ikke å time markedet. Hvor mange ganger har vi ikke hørt at fondskostnader er monsteret som gjemmer seg under senga? Kanskje vi burde fokusere mer på oss selv.

Dalbar Inc. lister opp 9 tendenser som påvirker oss, disse vil jeg skrive om dypere i nye innlegg senere.

- Loss Aversion.

- Narrow Framing.

- Mental Accounting.

- Lack of Diversification.

- Anchoring.

- Optimisme.

- Media Respons.

- Regret.

- Herding.

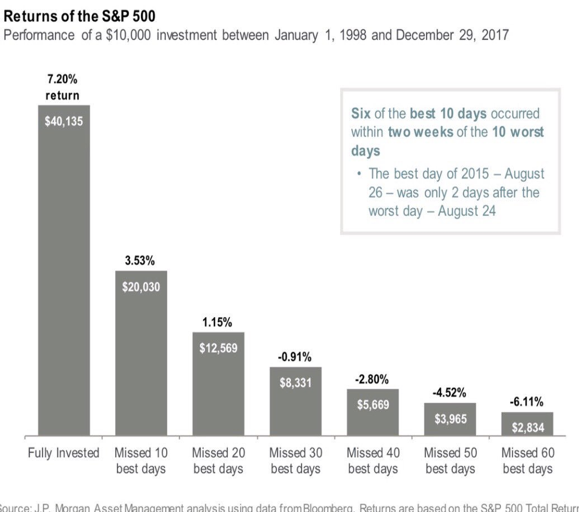

Seniorstrateg Christian Lie viste til en analyse fra J.P. Morgan på Twitter, og der kommer det fram at å miste 10 av de beste dagene i aksjemarkedet, ødelegger avkastningen oppsiktsvekkende mye. Ved å være fult investert i et S&P 500 indeks fond fra 1998 til å med 2017, ville du fått 3,57 % høyere årlig avkastning, enn om du prøvde å time markedet, og bommet på de 10 beste dagene. Samtidig kom 6 av de beste dagene innen to uker av de 10 dårligste dagene, det passer bra for oss som selger i panikk.

i et S&P 500 indeks fond fra 1998 til å med 2017, ville du fått 3,57 % høyere årlig avkastning, enn om du prøvde å time markedet, og bommet på de 10 beste dagene. Samtidig kom 6 av de beste dagene innen to uker av de 10 dårligste dagene, det passer bra for oss som selger i panikk.

I en annen studie av Barber og Odean (2000), fant de ved å analysere 66.465 kontoer holdt av private investorer i perioden 1991 – 1996, at den gjennomsnittlige investoren underpresterte med 3,7 % årlig. Grunnen, fant de, er at vi handler for ofte, som betyr høye transaksjonskostnader, og at vi fokuserer på mindre selskaper, som betyr høyere risiko. For å gjøre det tydeligere, pekte de på 20 % av investorene som handlet hyppigst, de underpresterte indeksen med 10,3 % årlig. 10,3 %. Barber og Odean pekte på at vi handlet for mye, og fokuserte på risikable investeringer, på grunn av høy selvtillit, eller sagt på en annen måte, overdreven tro på egne evner. Igjen, psykologi.

Derfor er det viktig å vite om investorpsykologi

Vi er elendige til å time markedet, vi har ikke tålmodighet, vi klarer ikke å holde fondene gjennom vanskelige tider, og vi handler for hyppig. På grunn av dette, forsvinner avkastningen vår og renters rente effekten. Dette har rot i vår psykologi. Vil du kunne øke avkastningen dine ved å være oppmerksom på dette tema? Ja.

MEN DET GJELDER IKKE MEG, gjør det?

Vi har jo en overdreven tro på oss selv, på engelsk overconfidence-bias, og derfor vil vi ikke tro at dette gjelder oss.

Nettside om finans, sparing og personlig økonomi. Vårt mål er å bli økonomisk sterke ved å spare penger og investere smart.

Tilbakeping: Hvorfor er det Viktig å Spare i Aksjefond - Aksjer og sparing

I am a student of BAK College. The recent paper competition gave me a lot of headaches, and I checked a lot of information. Finally, after reading your article, it suddenly dawned on me that I can still have such an idea. grateful. But I still have some questions, hope you can help me.

Thank you for your shening. I am worried that I lack creative ideas. It is your enticle that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/en/register?ref=P9L9FQKY

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/pt-PT/register?ref=FIHEGIZ8

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

555

555

1

555

1

555

0’XOR(if(now()=sysdate(),sleep(15),0))XOR’Z

1 waitfor delay ‘0:0:15’ —

-5 OR 519=(SELECT 519 FROM PG_SLEEP(15))–

-5) OR 491=(SELECT 491 FROM PG_SLEEP(15))–

-1)) OR 636=(SELECT 636 FROM PG_SLEEP(15))–

X2zvQllM’ OR 263=(SELECT 263 FROM PG_SLEEP(15))–

Ttf7xHd3′) OR 380=(SELECT 380 FROM PG_SLEEP(15))–

gk3G7BCx’)) OR 854=(SELECT 854 FROM PG_SLEEP(15))–

1*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

1’||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||’

HO3ivAVv’)) OR 799=(SELECT 799 FROM PG_SLEEP(15))–

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555’||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||’

555

I am currently writing a paper and a bug appeared in the paper. I found what I wanted from your article. Thank you very much. Your article gave me a lot of inspiration. But hope you can explain your point in more detail because I have some questions, thank you. 20bet

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks. nimabi

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/fr/register?ref=DB40ITMB

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/uk-UA/join?ref=PORL8W0Z

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/zh-CN/join?ref=V2H9AFPY

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/lv/join?ref=UM6SMJM3

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/de-CH/register?ref=VDVEQ78S

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/tr/register?ref=B4EPR6J0

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/fr/join?ref=FIHEGIZ8

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/sl/register-person?ref=JHQQKNKN

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/zh-CN/register?ref=YY80CKRN

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/de-CH/register?ref=UM6SMJM3

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en-IN/register?ref=UM6SMJM3

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

where to buy stromectol – ivermectin 12mg online carbamazepine 400mg tablet

Your article helped me a lot, is there any more related content? Thanks!

order isotretinoin 40mg pill – dexamethasone online buy linezolid 600 mg

amoxicillin cheap – order valsartan 160mg for sale buy ipratropium 100 mcg online cheap

buy azithromycin tablets – tinidazole 500mg oral buy generic bystolic

Your article helped me a lot, is there any more related content? Thanks!

omnacortil 20mg sale – order prometrium pills order prometrium

Your article helped me a lot, is there any more related content? Thanks!

generic augmentin 1000mg – order ketoconazole generic buy cymbalta generic

buy generic doxycycline – albuterol inhaler glucotrol 5mg usa

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

brand augmentin 625mg – cymbalta cheap buy generic duloxetine over the counter

buy semaglutide medication – cyproheptadine 4mg pill buy cyproheptadine 4mg pills

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

buy tizanidine generic – hydroxychloroquine 200mg drug hydrochlorothiazide usa

buy cialis 10mg without prescription – order generic cialis sildenafil 100mg over the counter

viagra sildenafil 100mg – rx pharmacy online cialis cheap cialis 40mg

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

brand atorvastatin 80mg – cost amlodipine 5mg zestril cheap

Your article helped me a lot, is there any more related content? Thanks!

generic cenforce – order aralen 250mg pills buy metformin pill

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

purchase omeprazole without prescription – omeprazole online order order atenolol 100mg for sale

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/register?ref=P9L9FQKY

depo-medrol medicine – buy aristocort 4mg generic buy cheap aristocort

purchase desloratadine generic – buy desloratadine 5mg sale priligy 60mg ca

buy misoprostol paypal – where can i buy misoprostol order diltiazem 180mg generic

buy generic zovirax over the counter – buy allopurinol 300mg generic buy rosuvastatin tablets

buy motilium 10mg without prescription – sumycin 250mg drug flexeril uk

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

motilium price – buy flexeril sale cyclobenzaprine 15mg oral

purchase coumadin – buy metoclopramide 20mg generic order losartan 25mg online

levofloxacin pill – levofloxacin 250mg cheap zantac 150mg pills

buy esomeprazole 40mg capsules – buy topiramate buy imitrex 25mg pill

brand meloxicam – mobic medication purchase tamsulosin sale

order generic ondansetron – order spironolactone 100mg online cheap buy simvastatin 20mg pills

buy valacyclovir generic – valacyclovir where to buy fluconazole 200mg for sale

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

modafinil over the counter modafinil ca provigil ca buy cheap modafinil provigil 200mg generic modafinil 100mg price order provigil 100mg generic

Thanks towards putting this up. It’s well done.

Your article helped me a lot, is there any more related content? Thanks!

I am in truth happy to glance at this blog posts which consists of tons of of use facts, thanks towards providing such data.

buy azithromycin pills – buy ciplox 500mg buy flagyl 200mg generic

order rybelsus online – buy generic periactin 4 mg purchase cyproheptadine sale

purchase motilium generic – buy cheap motilium buy flexeril 15mg online

buy generic amoxicillin – combivent online where to buy ipratropium without a prescription

order generic zithromax – buy zithromax 250mg sale nebivolol 5mg oral

buy amoxiclav sale – https://atbioinfo.com/ purchase ampicillin pill

buy esomeprazole 40mg pills – https://anexamate.com/ where can i buy esomeprazole

medex online – blood thinner buy losartan generic

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

mobic 15mg drug – relieve pain cost meloxicam

generic deltasone 40mg – apreplson.com buy prednisone generic

Your article helped me a lot, is there any more related content? Thanks!

best otc ed pills – ed remedies best ed drug

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

order fluconazole generic – https://gpdifluca.com/# diflucan 100mg usa

cenforce us – cenforce 100mg tablet buy cheap cenforce

snorting cialis – fast ciltad cialis coupon walgreens

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

cialis bestellen deutschland – https://strongtadafl.com/# purchasing cialis

order generic zantac – online ranitidine over the counter

Your article helped me a lot, is there any more related content? Thanks!

buy viagra online australia – https://strongvpls.com/ cheap viagra no prescription online

More posts like this would force the blogosphere more useful. https://gnolvade.com/

This is a question which is forthcoming to my verve… Numberless thanks! Quite where can I notice the connection details due to the fact that questions? https://buyfastonl.com/amoxicillin.html

The thoroughness in this section is noteworthy. https://ursxdol.com/cenforce-100-200-mg-ed/

Palatable blog you be undergoing here.. It’s obdurate to espy strong worth article like yours these days. I justifiably comprehend individuals like you! Go through vigilance!! https://prohnrg.com/product/metoprolol-25-mg-tablets/

Thanks for sharing. It’s top quality. qu’est ce qui remplace le viagra professional en pharmacie

This website absolutely has all of the low-down and facts I needed there this subject and didn’t know who to ask. https://ondactone.com/product/domperidone/

I’ll certainly bring to skim more.

buy generic ondansetron for sale

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

order generic dapagliflozin – buy dapagliflozin online dapagliflozin cheap

buy generic orlistat – orlistat where to buy xenical price

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/lv/register?ref=B4EPR6J0

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

More posts like this would prosper the blogosphere more useful. http://wightsupport.com/forum/member.php?action=profile&uid=22097

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

You can protect yourself and your family by way of being wary when buying prescription online. Some druggist’s websites manipulate legally and provide convenience, solitariness, rate savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/norvasc.html norvasc

This is a question which is in to my verve… Numberless thanks! Unerringly where can I lay one’s hands on the connection details for questions? mГ©dicament prednisolone

This website absolutely has all of the bumf and facts I needed there this case and didn’t positive who to ask.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/pt-BR/register-person?ref=GJY4VW8W

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/register?ref=IXBIAFVY

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/cs/register?ref=OMM3XK51

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Just stumbled across p898casino. Looks like it might be a chill place to unwind after a long day. Will report back after a few rounds!

Slot game night is calling! Found this p828slot and I’m feeling lucky. Wish me luck, y’all!

Heads up, folks! If you’re looking to get in, check out this p828login. Hope it helps someone out there.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/en/register?ref=JHQQKNKN

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

betmgm va https://betmgm-play.com/ betmgm Minnesota

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/en-NG/register?ref=YY80CKRN

Immerse yourself in a wave of emotions from games. crown coins login offers convenient payments and support. Become a lucky one today!

Sweet Bonanza brings the party to your screen with vibrant graphics and high-reward gameplay. Land sweet bonanza slot scatters, activate bombs, watch your balance grow. The fun never stops!

crash game redefines crash gaming: cute theme, brutal tension, huge rewards! Choose your path difficulty and bet confidently. Master the cash out and climb the leaderboard!

No deposit, no problem — play chumba casino gives you free Sweeps Coins to start winning. Enjoy top-tier games and real cash prize potential. Sign up free!

No cap on withdrawals. No games rigged against you. Just stake rakeback code being Stake.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/register-person?ref=IXBIAFVY

The ultimate online gaming destination awaits at abetmgm. Sign up and claim up to $1,000 bonus cash plus $25 On The House. Experience world-class slots and live dealer tables on any device.

Step into Best slots on DraftKings Casino for unbeatable offers. New players: $5 play unlocks 500 spins on hot games + up to $1K lossback protection. Play real money, chase real wins!